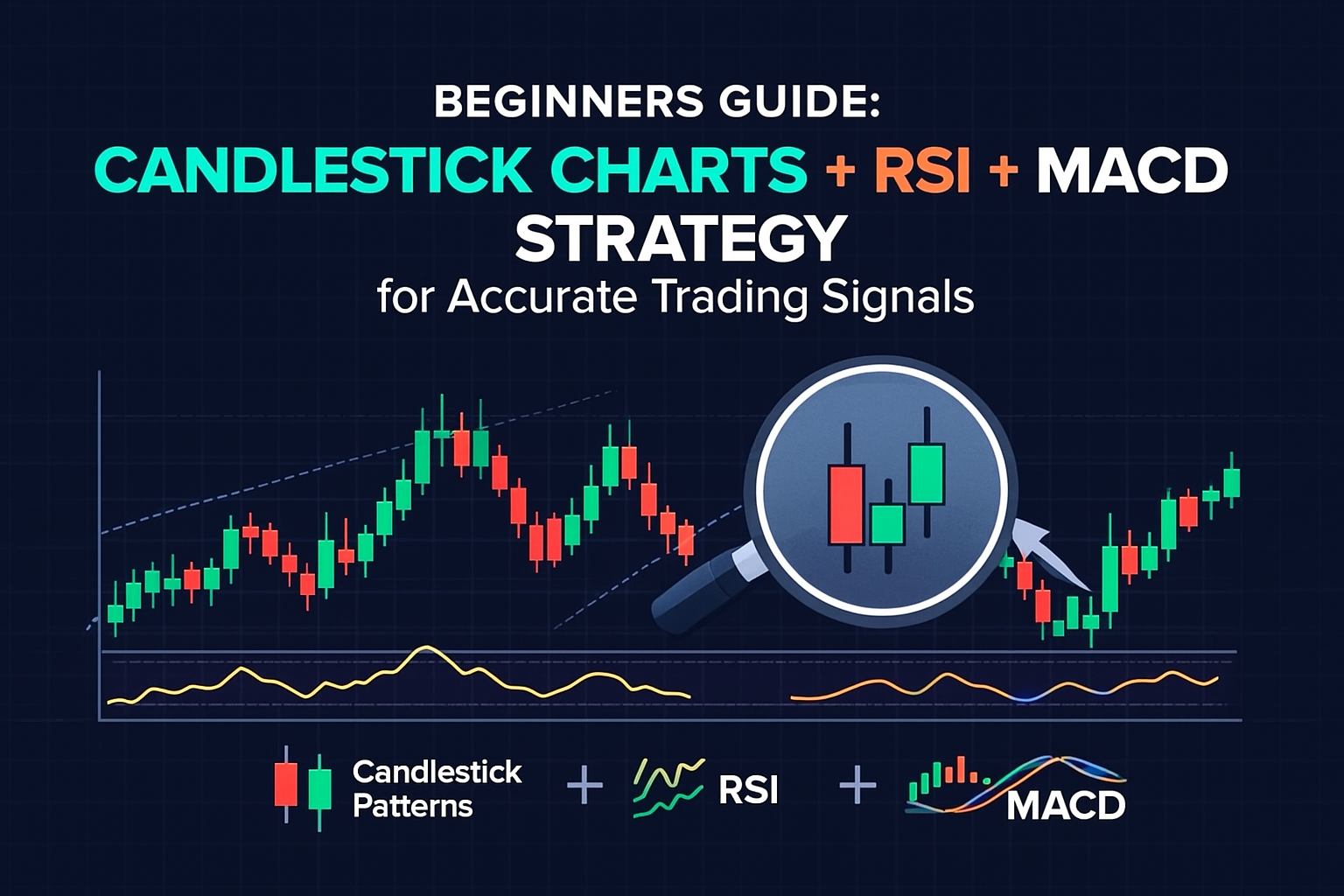

Beginners Guide: Candlestick Charts + RSI + MACD Strategy for Accurate Trading Signals

If you are new to trading and don't understand candlestick charts or indicators, this guide is for you. We will start from absolute basics — what a candlestick is, how to read it, why price patterns matter — and then we will build a simple but powerful strategy using RSI + MACD to take better trades.

📌 What is a Candlestick Chart?

Candlestick chart is a way to represent price movement of a stock within a specific time period (1 minute, 1 hour, 1 day etc). Each candle tells you four important things:

- OPEN: Price at the start of the time period

- CLOSE: Price at the end of the time period

- HIGH: Maximum price reached during that period

- LOW: Minimum price reached during that period

We use two types of candles:

- Green/Bullish Candle: Closing price is higher than opening price (price went UP)

- Red/Bearish Candle: Closing price is lower than opening price (price went DOWN)

Why are Candlesticks Important?

Because they show market psychology — Who is stronger right now? Buyers or Sellers?

Instead of looking only at numbers, candlesticks show emotions like:

- Fear (selling pressure)

- Greed (buying pressure)

- Reversals (trend changing points)

- Indecision (market confused, no direction)

Once you understand candles, you understand how the market behaves.

🟩 Basic Reversal Candlestick Patterns

These patterns often tell us when market can reverse direction.

- Hammer → Buyers rejected lower prices (bullish reversal)

- Bullish Engulfing → Strong buying pressure, trend may go up

- Shooting Star → Sellers rejected higher price (bearish reversal)

- Bearish Engulfing → Strong selling pressure, trend may go down

But candlesticks alone are not enough. Sometimes they work beautifully, sometimes they give false signals.

💡 So we combine them with indicators to increase accuracy.The 3-Step Beginner Strategy

This strategy combines:

- Candlestick Patterns

- RSI (overbought/oversold strength)

- MACD (trend confirmation)

This approach gives safer, confidence-based trade decisions.

🔶 Step 1 — Identify a Candlestick Reversal Pattern

- Hammer / Bullish Engulfing at support → Buy Possible

- Shooting Star / Bearish Engulfing at resistance → Sell Possible

Support means price has bounced from that level before.

Resistance means price previously rejected from that level.

🔶 Step 2 — Confirm strength using RSI

RSI (Relative Strength Index) shows if market is overbought or oversold.

- RSI below 30 = oversold → buyers may enter

- RSI above 70 = overbought → sellers may enter

If a bullish candle appears AND RSI is near 30 → BUY signal strengthens.

If a bearish candle appears AND RSI is above 70 → SELL signal strengthens.

🔶 Step 3 — Validate trend with MACD

- MACD Line crosses above Signal Line → Bullish confirmation

- MACD Line crosses below Signal Line → Bearish confirmation

MACD gives final approval before entering the trade.

Practical Example for Beginners

Imagine Nifty is falling, touches support, and forms a Bullish Engulfing candle.

✔ RSI = near 28 → Market oversold ✔ MACD = crossover upward → buying interest increasing ➡️ Buy Entry becomes strong and logical.🔒 Stop-loss = below candle wick 🎯 Target = previous swing high or next resistance

When to Avoid Trades? (Very Important)

- No clear trend (sideways market)

- RSI and MACD give opposite signals

- Entering trade without stop-loss

Trading is not prediction — it is probability. This method simply increases probability in your favor.

This content is educational, not financial advice. Practise first.